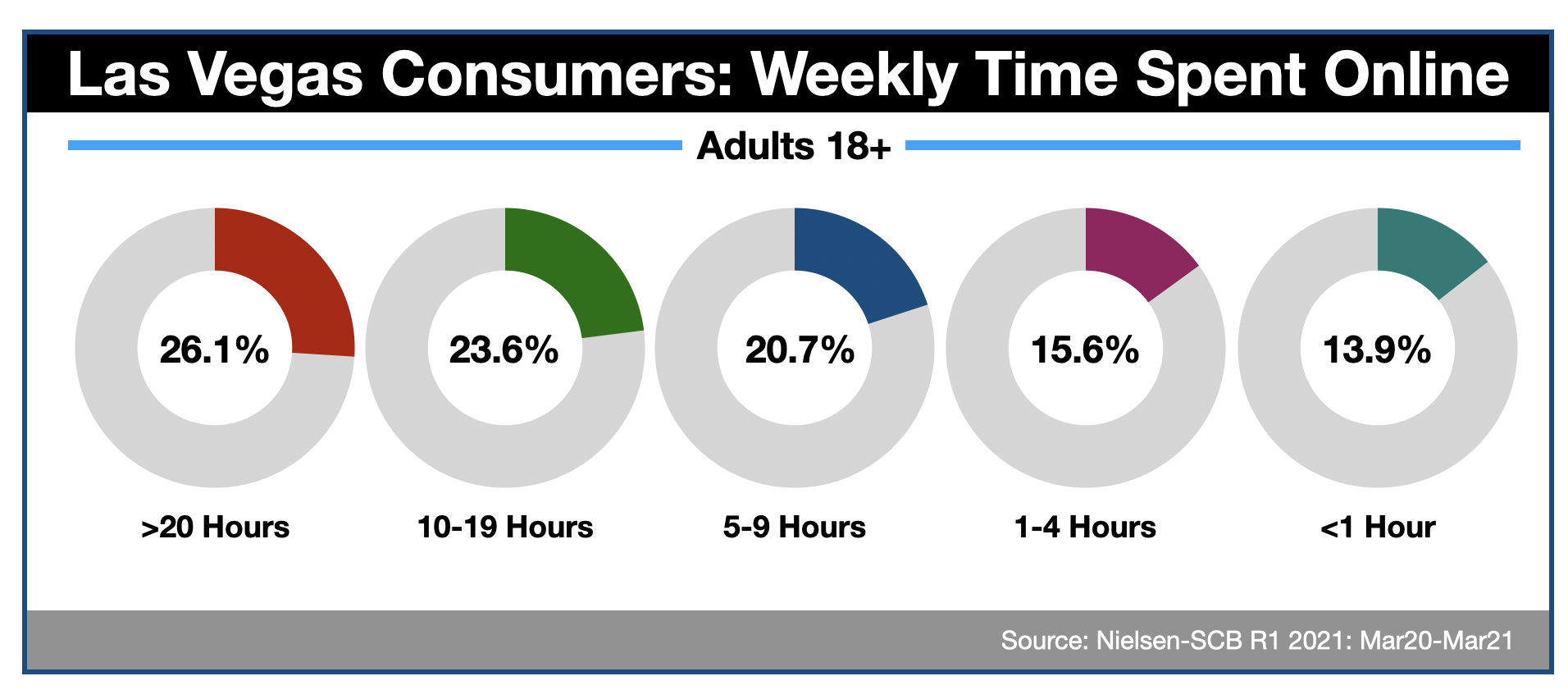

According to Nielsen, 1.7 million adults in the Las Vegas area have access to the internet, equivalent to 97.2% of the population. On average, local consumers are spending 10.8 hours per week online.

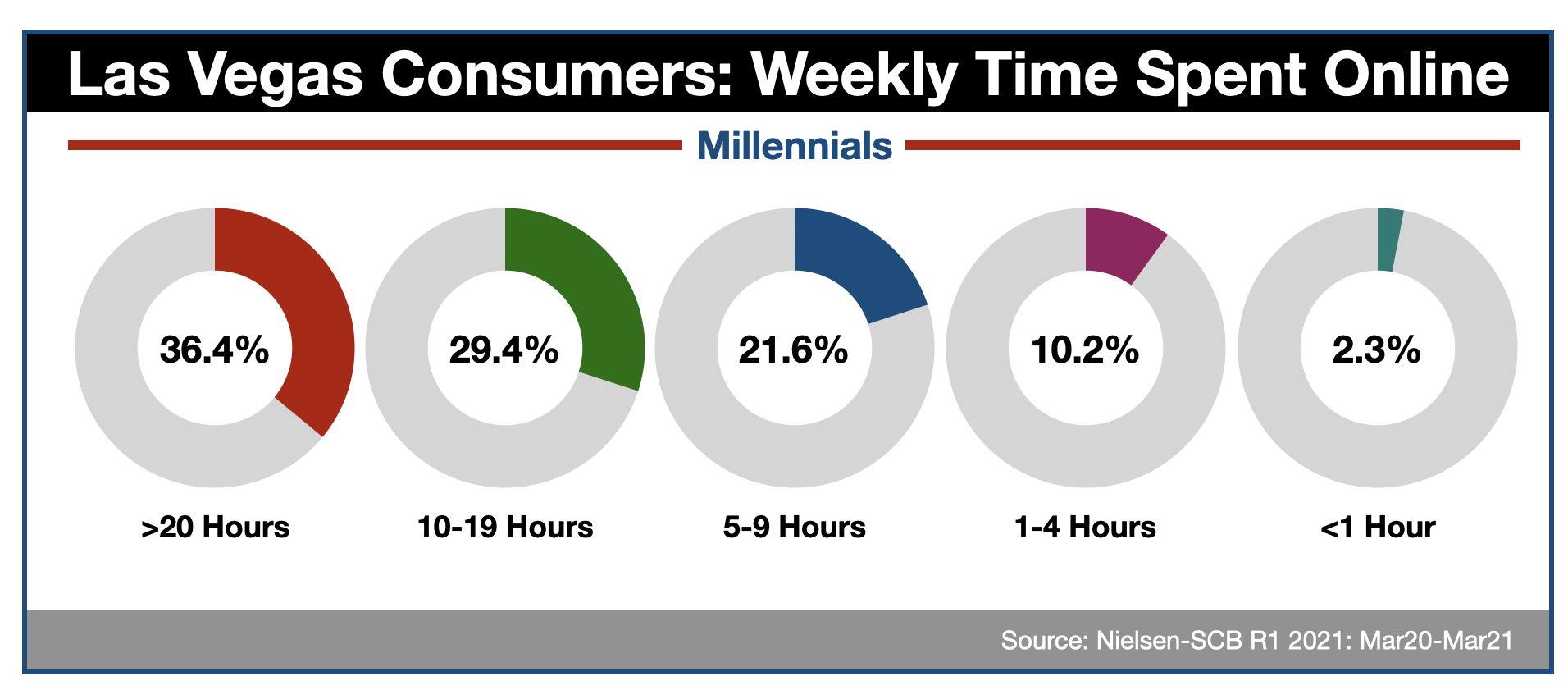

Las Vegas millennials, the first generation that grew up in a digital world, spend considerably more time online. Nielsen reports that, on average, Las Vegas's 25-39-year-old consumers are clocking 13.6 hours connected to the internet.

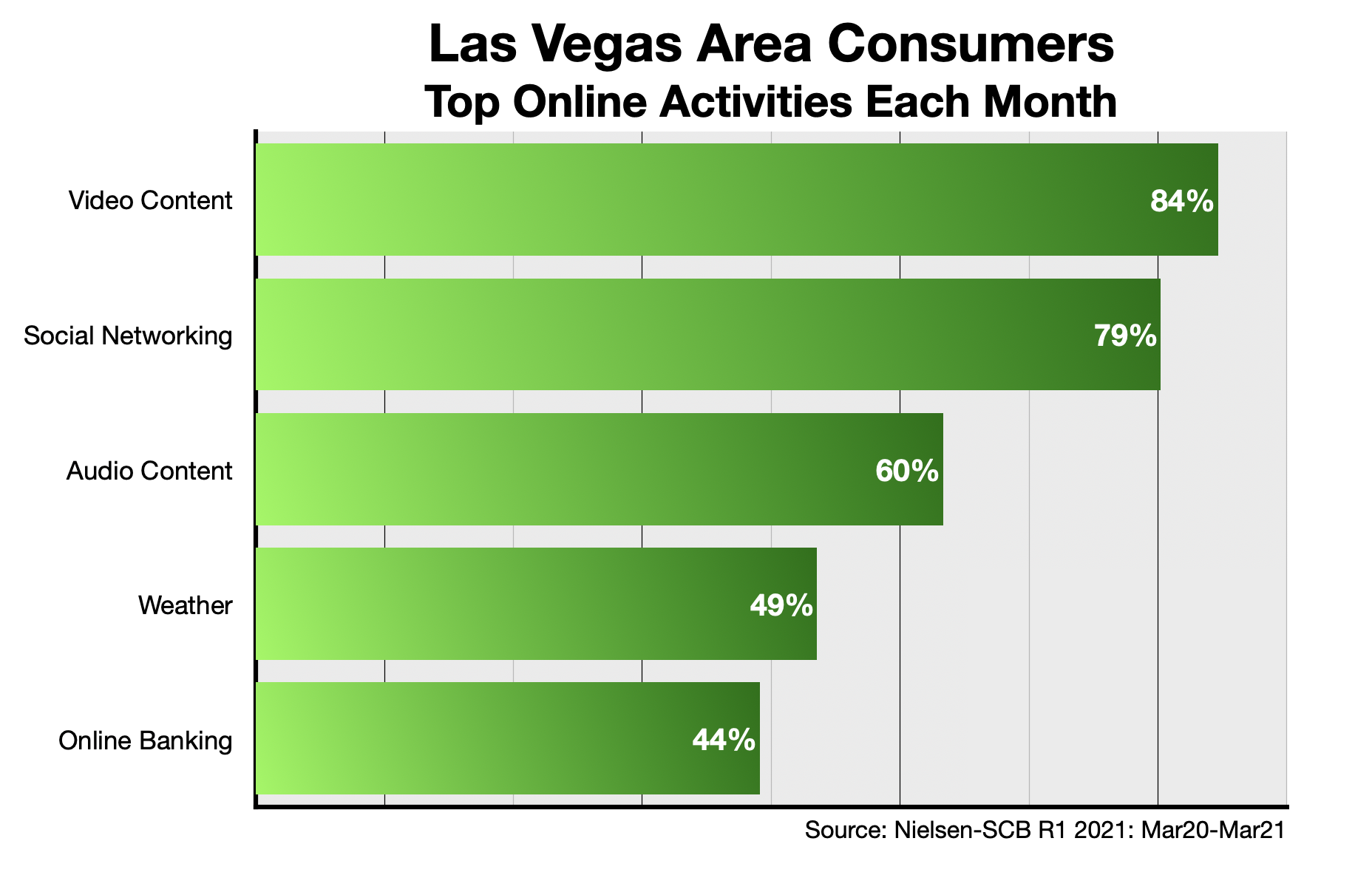

So, how are Las Vegas consumers spending their time online?

According to Nielsen, streaming audio and video content, social networking, checking the weather, and banking are the top online activities for Las Vegas consumers each month.

It is important to point out that among Las Vegas consumers who consume. online video content, more than 90% access Over-The-Top Television (OTT).

OTT, sometimes called connected-TV or CTV, consists of streaming services like Netflix, Hulu, Amazon Prime, and Disney Plus that provide long-form entertainment content similar to traditional television. The difference being, OTT is not delivered over the air or by cable. OTT programming can only be accessed via the internet using a computer, smartphone, tablet, smart-TV, game console, or an accessory like a Roku or Amazon Fire Stick.

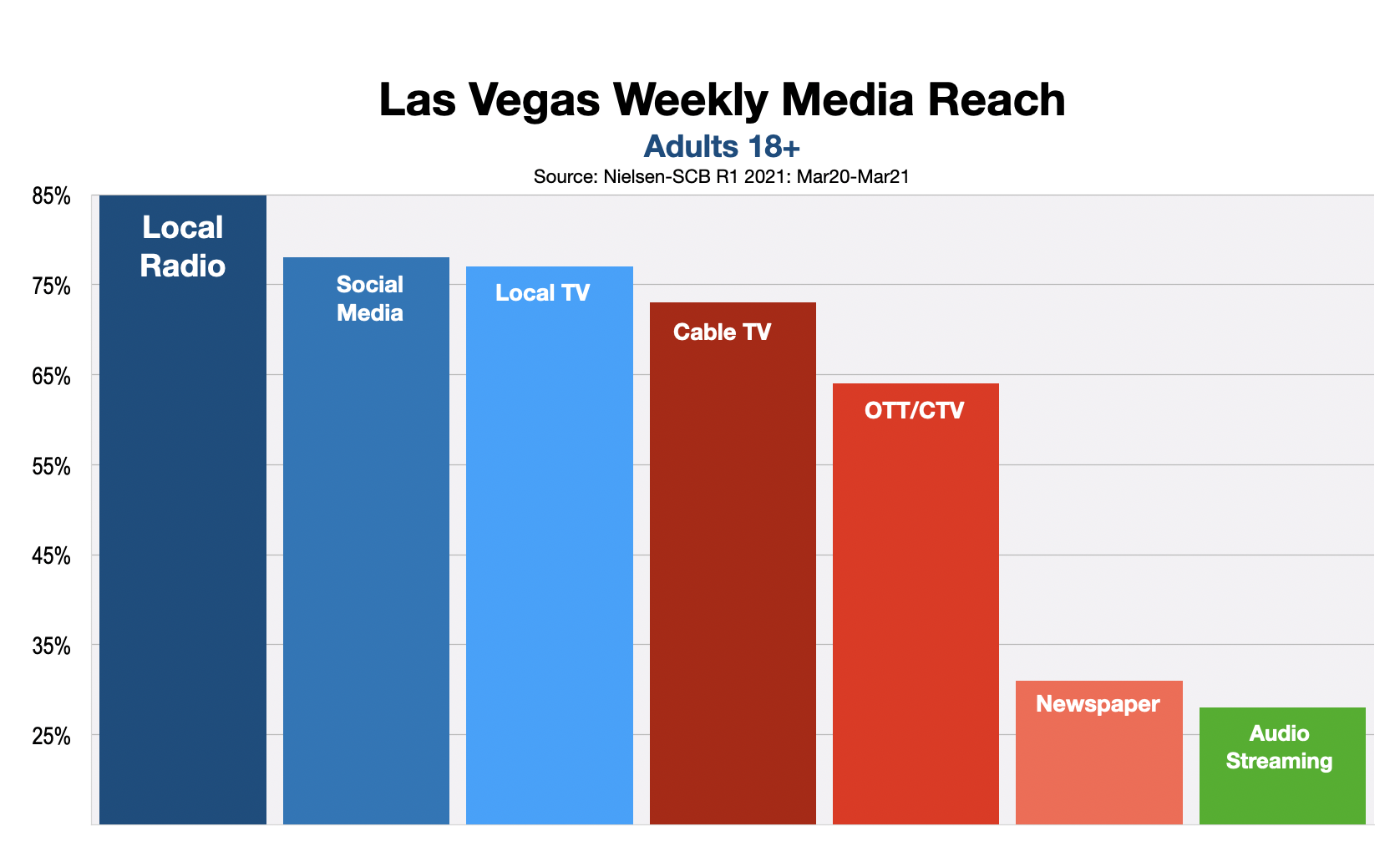

OTT reach among local consumers has achieved a level similar to that of legacy media options such as Las Vegas radio, TV, and cable.

As Las Vegas consumers continue to spend more time online, local business owners are investing more money on digital advertising options.

According to Borrell Associates, a company that tracks advertising trends across the country, in 2021, Las Vegas business owners are expected to spend $636 million to reach consumers while they are online. This represents a 16% increase versus 2020.

Of course, the primary reason why so many Las Vegas small business owners and retailers advertise online is to reach consumers while they are in the process of shopping.

Of course, the primary reason why so many Las Vegas small business owners and retailers advertise online is to reach consumers while they are in the process of shopping.

According to Nielsen, 80% of Las Vegas adults bought a product online during the past six months. Throughout 2020, these purchases totaled $12.5-billion. This amount is based on projections from eMarketer and represents a 32.4% increase versus 2019.

“We’ve seen e-commerce accelerate in ways that didn’t seem possible last spring, given the extent of the economic crisis,” said Andrew Lipsman, eMarketer principal analyst at Insider Intelligence. “While much of the shift has been led by essential categories like grocery, there has been surprising strength in discretionary categories like consumer electronics and home furnishings that benefited from pandemic-driven lifestyle needs.”

As the pandemic drags on, more and more consumers are shopping online.

During the past week, says Nielsen, 67% of all consumers shopped online. This compares to just 46% pre-pandemic. Most remarkably, just over 1/3 of all digital shoppers last week were brand-new users.

Furthermore, according to Nielsen, 23% of all consumers now shop online multiple times per week.